Initial Public Offers - IPO Consultants

Public Issue in relation to the Stock Market means invitation by a company to the public for subscribing the securities of the Company. The public issue may be Initial Public Offering (IPOs) or Follow on public Offer (FPOs).

Initial Public Offering (IPO) In initial public offering (IPO), the unlisted Company makes either fresh issue of shares or offer for sale of the exiting shares. It is the first sale of shares and debentures by a company to the public and a closely held Company being transformed into a widely held Company

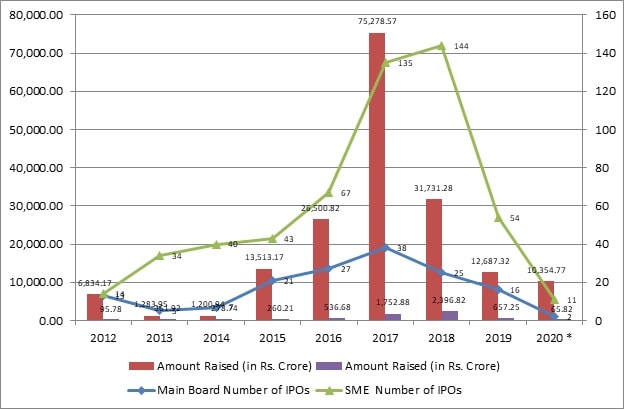

IPOs on Main Board and SME Board and Funds raised

REGULATORY FRAME WORK FOR IPOs

ELIGIBILITY NORMS FOR MAIN BOARD IPOs

SEBI GUIDELINES FOR SME IPO

ELIGIBILITY CRITERIA FOR SME LISTING

OTHER NORMS TO BE SATISFIED FOR SME IPO

OTHER NORMS TO BE SATISFIED FOR MAIN BOARD IPO

Minimum post issue capital should be more than Rs. 10 Crore. In addition, the SME IPO norms are also applicable.

DIFFERENCE BETWEEN MAIN BOARD & SME IPO

| S.No | Main Board IPO | SME IPO |

|---|---|---|

| 1 | Post Issue Capital more than 10 Crore | Post Issue capital should not exceed Rs. 25 Crore. |

| 2 | IPO Grading is mandatory | NA |

| 3 | Minimum no. of allottees 50 | Minimum no. of allottees 50 |

| 4 | Minimum Application Value is Rs. 10000-15000 | Minimum Application Value is Rs. 100000/- |

| 5 | Underwriting of issue is optional. | 100% underwritten issue. |

| 6 | Offer document is filed to SEBI for Vetting. | Offer document is filed to Stock Exchange for Vetting. |

| 7 | No requirement of market making. | Market making is compulsory. |

CCV provides full-fledged services for businesses seeking to list on stock exchange under Main Board & SME IPO. Our professional team prepares all the documents including the prospectus, files the applications, helps in acquiring investors to raise capital, and all related activities for submission of your company to the stock exchange in the shortest time. We follow a proven approach to cope with the market challenges and help companies adjust to the public infrastructure.

WE WORKS WITH OUR CLIENTS TO

Under this phase, we shall assist you in preparation of IPO and listing. Our scope of services under this phase shall mainly include Advisory in the following:

- Devising appropriate capital restructuring plan

- Setting up minimum corporate governance practices expected by a listed company from the perspective of Companies Act, LODR, listing norms, SEBI ICDR Regulations etc.

- Appointment and coordination of market intermediaries and other parties including the Underwriters, Market Makers, Registrars to Issue, Legal Advisor to the Issue, Bankers to Issue, PR Agency, Printer etc.

- Devising a complete IPO plan and strategy including the likely post-issue shareholding distribution pattern.

- Coordinating with Peer-Review Auditors for restatement of financials of the Company as required under SEBI (ICDR) Regulations.

- Obtaining ISIN from the Depository(ies) and dematerializing pre-IPO shares of the Company.

Under this phase, we shall carry out a due diligence and our scope of services shall mainly include the following:

- Carry out a preliminary background check

- First-level due diligence based on the preliminary information / documents to be provided by the Company and publicly available information.

- Visit the Company office(s) and factory.

- Hold discussions with the management, auditors and legal advisors to the Issue.

- Finalize the due diligence report in consultation with Legal Advisor.

Under this phase, we shall carry out valuation exercise and our scope of services shall mainly include the following:

- Ratio analysis such as EPS, BVPS, RONW etc., as may be required under SEBI ICDR Regulations.

- Industry analysis from valuation perspective.

- Identification of peer comparable.

- Peer analysis and pricing of peers listed on stock exchange.

- Determining issue pricing and size for discussion with the management.

Under this phase, we shall give observations on IPO Offer Document and other important agreements, documents and resolutions necessary for an IPO process. An indicative list of important documents is as under for easy understanding:

- IPO Offer Document

- Tripartite Agreement with NSDL, CDSL and Registrar to Issue.

- Underwriting Agreement.

- Market Making Agreement.

- Agreement with Bankers to Issue.

- Agreement with Registrar to Issue.

- Board / Shareholders’ Resolutions.

- Certificates, Letters of Representations etc.

- Draft of public advertisements, notices etc.

- Forms / Applications to be filed with Stock Exchange, RoC and other regulatory office(s).

We shall assist in complete end-to-end IPO process including the following activities:

- Filing of IPO Offer Document with Exchange(s) and other regulatory offices like SEBI and RoC.

- Coordinating and assistance in interview with Exchange Listing Advisory Committee.

- Follow-up with Exchange(s) and RoC for their approvals.

- Execution of agreements with other market intermediaries.

- Assistance in launch of IPO and coordinate with other parties including PR Agency, Printers for adequate public advertisement, distribution of application forms as required statutorily.

- Monitoring the flow of applications and timely updation with the management of the Company.

- Coordinating with bankers and registrars for deposit of application moneys and finalization of allotment list in consultation with the stock exchange.

Finally, post IPO closure and finalization of allotment; we shall initiate the activities for listing of equity shares of the Company on SME Exchange. We shall advise in the following activities under this phase: